According to the National Association of Realtors®, 86% of homebuyers used financing to purchase their home. For first-time homebuyers, that number jumps to 94%. Which means that if you’re currently looking to buy a home—or hope to in the future—the odds are good that you’ll need to borrow some amount of money for the purchase. If that seems daunting, bear in mind that millions of others have successfully navigated the home loan process to become proud homeowners.

While the average homebuyer borrows 88% of the sales price of the home, you might have the option to borrow even more—depending on your finances, credit history, and what type of loan you qualify for. In fact, you might not even need to pay any money out of pocket for a down payment! That’s why it pays to understand the ins and outs of securing a home loan, especially if it’s your first time.

To help you get started, we’ve outlined the basic steps of the process below.

Determine Your Budget

How much are you willing or able to spend on your new home? When calculating a mortgage, don't forget that you will also be paying for homeowner's insurance and taxes.

Get Prequalified

Prequalification provides a general estimate of your ability to qualify for a home loan. The way it works is that you provide a lender with basic financial information about yourself and allow the lender to run a credit inquiry. The lender then uses this financial snapshot to assess:

- Whether you have the credit score and payment history to qualify for a home loan

- Which home loan type might be your best fit

- Your target price range

- How much you might need for a down payment

Keep in mind that you’re not actually applying for a loan at this stage, merely gaining a ballpark insight into your ability to purchase a home. This is a powerful tool because it lets you know whether you’re able to buy a home now, and if not, what steps you’ll need to take to eventually qualify for a home loan—for example, saving more money for a down payment or building up a better credit score.

Get Preapproval

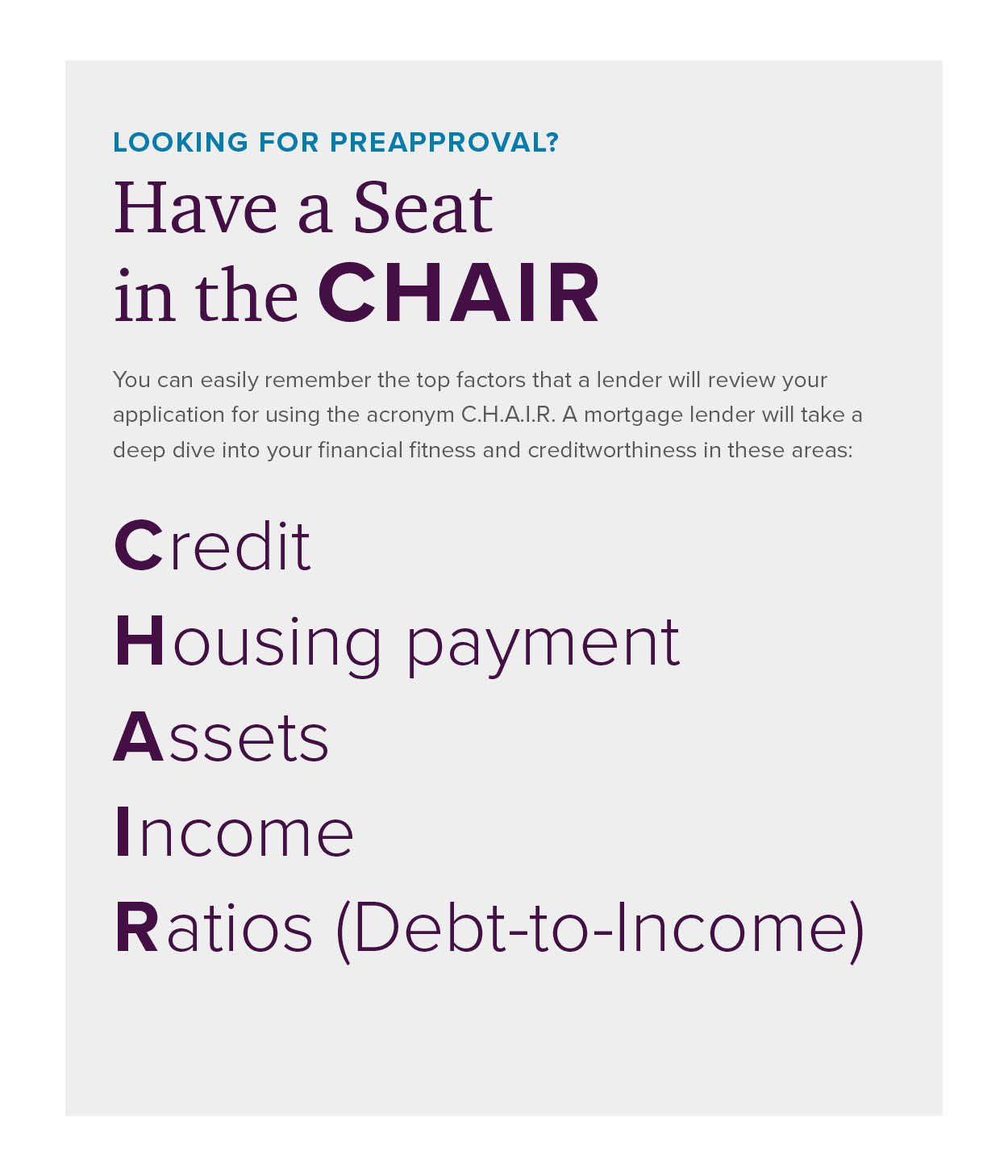

Prequalification is the step of filling out an application to find out if a lender will conditionally approve you for a home loan. Using a thorough credit check and information provided in your application, a mortgage lender will take a deeper dive into your financial fitness and creditworthiness. If you’re a qualified buyer, the lender will conditionally approve you to purchase a home for a specified amount of money.

Why is the approval conditional? Home purchases can take time, so your lender will want to make sure that nothing hinders your ability to purchase between the time you enter into a contract on a home and the time the transaction is approved. For example, if you experienced a job loss or made another large purchase—like a new car—it could make it less likely that you’ll be able to afford a home. This is all known as the underwriting process.

Your lender may also need to request follow-up documentation, to fill in missing financial information and address potential red flags in your credit report. If that sounds like a lot to keep track of, don’t worry; your lender will provide a needs list and walk you through exactly what they need to work toward final approval.

Your lender may also need to request follow-up documentation, to fill in missing financial information and address potential red flags in your credit report. If that sounds like a lot to keep track of, don’t worry; your lender will provide a needs list and walk you through exactly what they need to work toward final approval.

Tip! You can easily remember the top factors that a lender will review your application for using the acronym C.H.A.I.R.

- Credit

- Housing payment

- Assets

- Income

- Ratios (Debt-to-Income)

Finally, It's Closing Time!

If everything goes smoothly throughout the contract phase, you’ll arrive at the big moment: closing day! This is where all three parties—you, the seller, and the lender—agree to proceed with the purchase. This entails signing final paperwork and exchanging money to make the transaction official.

What you'll need:

- Down payment

- Money for closing costs (Fees you pay the lender to facilitate the transaction)

- Proof of homeowners insurance

Get started

Our affiliate lender, Inspire Home Loans, is ready to help you start your home loan process through a quick and easy prequalification process. Get prequalified today >>

Already prequalified? Start your home search here >>